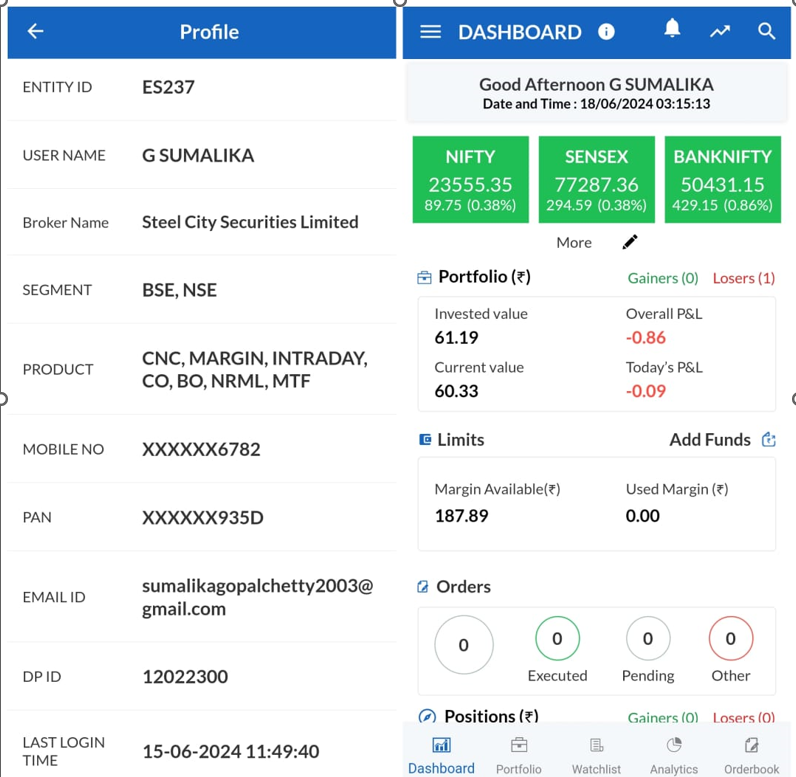

STEEL CITY SECURITIES LIMITED

Steel City Securities Ltd. is a retail stock broking company headquartered in Chennai, India, that was founded in 1995. It offers a range of financial services, including stock broking, depository participant services, and distribution of insurance products. The company is listed on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Steel City Securities Ltd. has a presence in southern India and provides trading platforms for equity, derivatives, commodities, and currency derivatives.

A Three-Year Analytical Study of Eight Companies(April 1st 2021 -MARCH 31 ST 2024)

THREE YEARS STOCK ANALYSIS ON:

- PORTFOLIO A

- RELIANCE INDUSTRY

- TATA CONSULTANCY SERVICES

- POWER GRID

- INDIAN TOBACOO LIMITED

- PORTFOLIO B

- AIRTEL

- TATA STEEL

- LARSEN AND TURBO

- TITAN

Portfolio Management Overview

The study was conducted to evaluate portfolio performance (2021–2024), with a focus on constructing portfolios that align with investor objectives, such as maximizing returns and minimizing risks. By applying both theoretical and quantitative techniques, the research aimed to assess the effectiveness of portfolio diversification. The study utilized secondary data from stock exchanges and financial reports, with the NIFTY50 benchmark index analysis providing a reference for comparative performance. Key analytical tools, including beta analysis, Sharpe ratios, and variance, were employed to measure risk-adjusted returns and assess the overall success of the portfolios in achieving their targeted objectives.

PORTFOLIO A

- Reliance Industries Limited: A diversified conglomerate with strong market presence in oil, gas, retail, and digital services.

- Tata Consultancy Services (TCS): A leader in IT and consulting services, known for its innovation in AI and digital transformation.

- Power Grid Corporation of India: A stable utility company engaged in power transmission and telecom services.

- ITC Limited: A consumer goods company with significant contributions to the FMCG, hospitality, and tobacco sectors.

Portfolio A employed a strategic mix of high-growth stocks (Reliance, TCS) and stable, dividend-yielding stocks (Power Grid, ITC). Using beta, Sharpe ratios, and standard deviation, the portfolio balanced risk and return, leveraging diversification to optimize performance while aligning with moderate-risk investor objectives.

PORTFOLIO B

Methodology:

- Sectoral Diversification: Portfolio B might have focused on contrasting sectors, such as technology, financial services, and manufacturing, to mitigate sector-specific risks.

- Performance Metrics: Similar tools (beta, Sharpe ratio, standard deviation) were applied to evaluate the portfolio’s performance under different market conditions.

- Risk-Return Trade-Off: Depending on the investor’s preferences, the portfolio’s asset mix may have leaned toward higher-risk, higher-reward investments or more conservative choices.

Findings: Portfolio B provided insights into how different combinations of assets perform under varying market scenarios, offering a point of comparison to refine future investment strategies.

Conclusion

The study underlined the significance of portfolio construction and management in achieving investment objectives. Key takeaways include:

- Importance of Diversification: By mixing stocks from diverse sectors and with varying beta values, Portfolio A successfully minimized unsystematic risk while maintaining returns.

- Quantitative Analysis: Metrics like beta, Sharpe ratios, and variance are indispensable in assessing portfolio efficiency and guiding asset allocation decisions.

- Investor-Specific Strategies: Portfolios should be tailored to individual risk tolerances and financial goals. For instance, Portfolio A was suitable for moderate-risk investors, whereas Portfolio B might have catered to either conservative or aggressive investors based on its composition.

The findings emphasize that strategic portfolio management is a dynamic process, requiring regular performance reviews and adjustments to align with changing market conditions and investor needs.

- About me

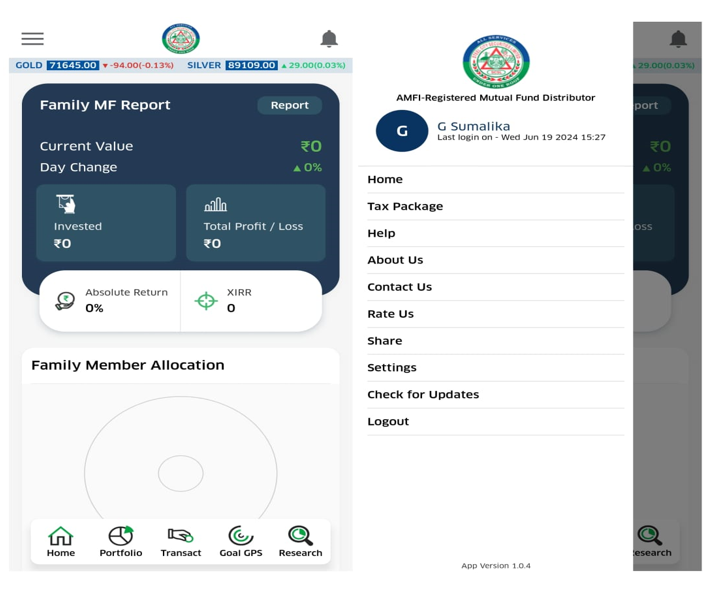

PGDM student specializing in Finance and Marketing, Finance Club Coordinator, certified in Excel and NISM Investor. Passionate about portfolio management and entrepreneurship.

- our services

- Copyright ©

- 2024

- Portfolio | All Rights Reserved